It may seem counterintuitive but you’re saving money by avoiding the high interest rate of your creditor. If you have debts, all repayments that go beyond the monthly minimum will be recorded in this category.Contributions to my employer’s pension plan.It may very well be that your current situation does not allow you to set aside 20% of your income, in this case determine the amount you can set aside every month. With time, it will allow you to turn your dreams into reality.

Saving is not boring! This very important part will make it possible for you to no longer live from one paycheck to another. Bringing lunch to work is still a work in progress. It is an amount which is hard to understand when you are spending $10 here and $20 there but it does add up! Retrospectively, I would have been happier with another trip rather than spending mindlessly my money because I’m too lazy to cook.Īs you can see, restaurants are still a big part of my spending. For example, in 2018 I spent almost $2,500 in restaurants. Since 2018, I have a detailed Excel document tracking my expenses, when I reviewed the previous years it made me ponder on how I spend my money. Whatever you choose is OK, as long as it’s what makes you happy. The key is to examine your desires: maybe you delight yourself with a fancy coffee every morning or your thing is to go to a trendy restaurant once a month or even to take a nice trip once a year. This category is for your pleasure, you can do anything you want with it as long as you do not overspend. Being able to spend a little for my enjoyment helps me not to go on a shopping binge because I am feeling deprived. It’s like for diets, it takes cheat days to balance everything out. It is very important to have an area of freedom and to know that pleasure still has a place in your life. Just because you live on a budget, it doesn’t mean you can’t have fun.

This is how I allocate my “needs” expenses for 2020.

#50 30 20 budget spreadsheet free#

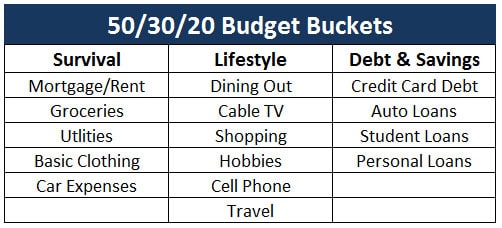

We often remember the amount of our recurring bills but it’s difficult to estimate how much we spend exactly on clothes or in restaurants.įor those who prefer to do this exercise using a computer, I have prepared a free Excel template to create your own 50-30-20 budget. Sure, it’s tedious but there is no better way to get an accurate picture of your expenses. Now take your bank and credit card statements and categorize your expenses. At the top of the columns, enter the amounts corresponding to the different categories. And then make three columns: needs (50%), wants (30%) and savings (20%). To start making your budget, you have to go to the source of it all: payslips and account statements.Ĭhoose a standard month and start by writing down your net employment income as well as all other recurring income (family allowances, invalidity pension…). Making your budget will not instantly change your life, but it does provide a solid foundation on which to base your financial decisions. The first step is to eliminate bad debts and then you can go on to create wealth. The most important thing is to spend less than what you are earning. Getting in control of your money is an insurance policy against life accidents and an accelerator for your projects. Having one means having all the cards in hand to make good decisions that have an impact today, but which might also have one for the next 25 years. My budget has helped me overcome hardships in the past (separation, illness…). It’s very straightforward but I wanted to find more tips about budgeting so I could share them with you. Since then, my life and needs have evolved and I wanted to read Elizabeth Warren’s book, the creator of this money managing method: All Your Worth: The Ultimate Lifetime Money Plan. After looking on the internet, I created a very simple Excel document to help me manage my finance.

#50 30 20 budget spreadsheet for free#

Try Tiller for free for 30 days and access exclusive budgeting templates to streamline your financial journey.I started using the 50-30-20 budgeting method in 2011 when I began working full time in Paris. Remember, at Tiller, we’re dedicated to helping you achieve your financial goals. Take advantage of the power of Google Sheets, and start your journey to financial success today! Whether you’re a budgeting novice or an experienced financial guru, these templates offer a range of options to help you manage your money effectively.

In this ultimate guide, we’ve introduced you to the best free Google Sheets budget templates for 2023. It works best when used in conjunction with Sheets’ monthly budget template.Īt the end of each month, simply transfer the totals for each category from the monthly budget template to the annual budget template to see a broader view of your finances. Google Sheets’ native annual budget template provides a very simple overview of yearly income and expenses.

0 kommentar(er)

0 kommentar(er)